1. 캘리포니아에서의 2022년 Zev 판매량은 345,818대로 작년대비 60% 성장했습니다.

이러한 성과는 테슬라 덕분이며 테슬라 비중은 62%였습니다.

Tesla continues to lead the California ZEV market in 2022 with a nearly 62% share. The company sold more than 1.5x the number of vehicles of all other automakers combined. Note that this impressive result includes plug-in hybrid electric vehicle sales, which still primarily rely on an internal combustion engine.

Tesla's sales in California are on the rise again, edging out competitors with internal combustion engines. Sales of zero-emission vehicles (ZEVs) reached 345,818 units in 2022, up nearly 60% from a year earlier, according to California's Energy Commission data. This accounted for 18.8% of all auto sales in the state, registering a large influx, largely thanks to Tesla. Of these, 292,496 were battery electric vehicles (BEVs), 50,748 plug-in hybrid electric vehicles (PHEVs), and 2,574 fuel cell electric vehicles (FCEVs). At the same time, sales of Tesla cars are more than twice as high as all automakers in the ZEV segment combined.

https://www.tesmanian.com/blogs/tesmanian-blog/tesla-became-the-absolute-leader-in-the-california-zev-market-in-2022-delivering-more-than-2x-more-vehicles-than-all-brands-combined

2. UBS는 테슬라가 비용과 기술 리더십 덕분에 업계 전반의 쉐이크 아웃에서 확실한 승자라고 말했습니다.

PT는 $350 에서 $220으로 낮췄지만, 매수 등급을 강조하고 있습니다.

The firm wrote that globally, “Tesla's latest round of price cuts has put pressure on all competitors in the mass and premium-entry segment, both in EV and ICE. On the EV side, expect Tesla as a cost and technology leader (and the leading Chinese EV players) to continue expanding volumes aggressively, leveraging its superior cost structure overall legacy competitors and smaller EV players.” Analysts see it as the beginning of an industry-wide shakeout.

The UBS DCF-based valuation now suggests a fair value of $220 per share instead of $350. This is driven by lower earnings and FCF forecasts from the firm, mainly on lower prices (but only on slightly lower volumes) than before. The bigger cuts (in %) are only relevant in the near term as a price normalization had already been expected in the coming years. Analysts reiterate a Buy rating and see Tesla as best positioned of the stocks they cover in the sector to be a relative winner in the likely upcoming industry shakeout.

https://www.tesmanian.com/blogs/tesmanian-blog/tesla-is-a-clear-winner-of-the-industry-shake-out-thanks-to-cost-and-tech-leadership-says-ubs

3. 모델 Y로 가득 찬 30대의 배송 트럭들이 오늘 아침 덴마크 리베에 있는 테슬라의 쇼룸과 서비스 센터에 도착했습니다.

https://twitter.com/tsla_ownrs_dk/status/1617565168611000320?s=46&t=3DcbrAHu-t7iV9UFOxmmHg

트위터에서 즐기는 Tesla Club Denmark

“30 trucks filled with new @Tesla Model Y’s arrived this morning at Tesla's showroom and service center in Ribe, Denmark⚡️😍 H/T JyskeVestkysten 📸”

twitter.com

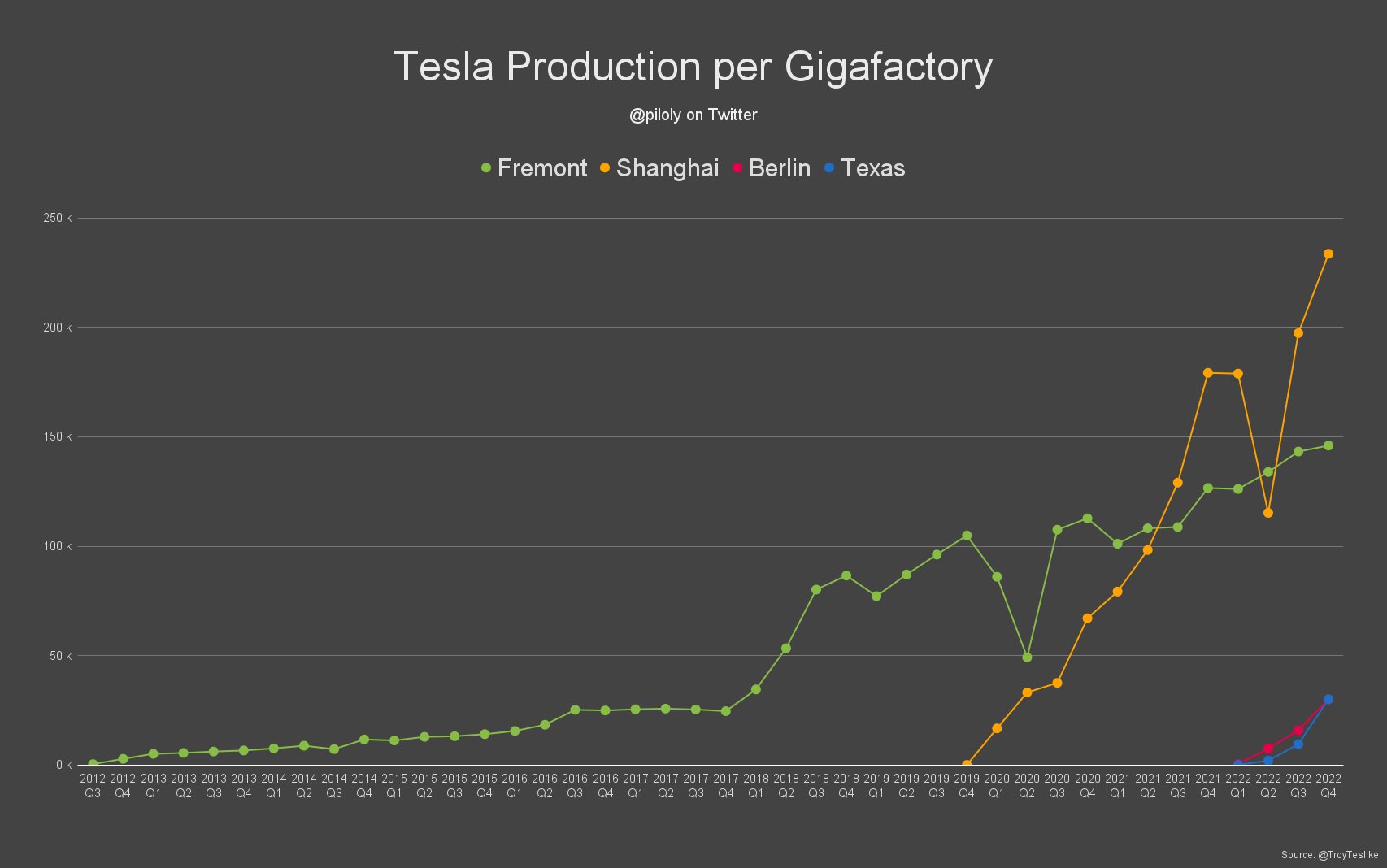

4. 기가 팩토리들의 각각의 생산량입니다.

반응형

'테슬라(Tesla)' 카테고리의 다른 글

| 2023. 1. 26. 테슬라 소식(2022Q4 어닝) (19) | 2023.01.26 |

|---|---|

| 2023. 1. 25. 테슬라 소식 (13) | 2023.01.25 |

| 2023. 1. 23. 테슬라 소식 (16) | 2023.01.23 |

| 2023. 1. 22. 테슬라 소식 (9) | 2023.01.22 |

| 2023. 1. 21. 테슬라 소식 (20) | 2023.01.21 |

댓글